Cyprus is a small island in far eastern part of the Mediterranean Sea many people know nothing about. But the recent banking crisis in Cyprus has raised many eyebrows; not only in the Euro Zone but also in Russia and the United States.

The question is not so much what happened in Cyprus, but could what happen in Cyprus occur in the United States? The answer will come, but first some background on the U.S. current monetary regime that started in 1971.

Global banking systems, whether in Europe, Japan, China, or the United States, are debt-based systems using fiat currencies. In every case Central Banks control two critical money components; the printing of money and the cost of money. Most Central Banks can simply print money at will and control the cost of money because they set the interest rates. Based on current monetary policy across major Central Banks the major beneficiaries are governments and the banking sector.

The entire banking system creates an inherent conflict with those that created the system and the people. Money (as we use the term today) is used as deposits by savers (asset to the saver and a liability to the bank) and debt is created when banks extend credit to borrowers (debts by the borrowers and assets to the banks). This is how real people interact with the traditional banking system.

On the other hand, our Government borrows the difference between its expenses and its revenues. In budgetary terms this is a deficit and deficits add to the national debt. When government borrows it sell securities to buyers such as foreign governments, primary dealers, and direct and indirect bidders.

Once debt is incurred it becomes nominal because the price is reflected at the time of the transaction. The debt isn’t adjusted for inflation. In other words, if you incur a dollar of debt twenty years ago you only need a dollar to pay the debt, regardless of what that dollar may purchase today. In real terms, for purchases made today, the dollar’s purchasing power is adjusted for inflation. In real terms (purchasing power) the dollar buys fewer goods. In nominal terms, a dollar pays off a dollar of debt.

This is an important distinction for many reasons. Government funds its deficits by borrowing money through the sale of securities. Those securities have different lengths of maturity (2 year, 7 year, 10 year, 30 year, etc.), and pay interest when redeemed. If the government wants to run bigger deficits it simply sells more securities. The result is a larger debt and an increase in interest payments.

The Federal Reserve receives dollars from the buyers of the Government’s securities, deposits those funds, and transfers them to the U.S. Treasury for the government to pay for its profligate spending. As the U.S. debt increases and annual deficits expand into the trillions of dollars, buyers become concerned as the repayment risk increases. Buyers may demand higher interest rates to continue buying our debt. But if the Fed increases interest rates it also means the interest payments on the outstanding debt increase requiring a larger percentage of total government payments to service that debt.

This is where the Fed steps in and monetizes the debt. The Federal Reserve is also a buyer of the securities it sells. The Fed holds many auctions of different securities every month. If one auction is $30 billion of 7 year notes at x % interest and the total buyers (excluding the Fed) only buy $20 billion of the debt, the Fed steps in and buys the $10 billion not otherwise sold. The Federal Reserve buys it as a direct bidder (who is anonymous). And makes digital entries to transfer $10 billion to the U.S. Treasury and adds $10 billion onto the Federal Reserve’s balance sheet. Ten billion dollars is now with the U.S. Treasury for the Government to “spend”. This is how debt is monetized.

Interest rates have both advantages and disadvantages depending on your perspective. If you are a net producer (a saver), someone living on fixed income like Social Security, etc. low interest rates are inimical to your interests. After your expenses if you have excess earnings you are a net producer. If you deposit your excess earnings into a savings account and earn < 1% interest there is no incentive to save (especially when inflation exceeds the interest rate you have real negative interest rates and lose money by depositing it in a savings account).

When Governments run deficits and accrue large national debts high interest rates are inimical to its interest because higher interest rates result in more debt service. For a net producer, higher interest rates are good. So, the interests of the government and the interests of a net producer are, for the most part, diametrically opposite.

Likewise, there are net consumers that spend more than they earn. These people are borrowers who take on debt through credit expansion. For these people, low interest rates are good. In fact, we can be a net producer and take on debt (like a mortgage) where we’d prefer a low interest rate on our mortgage but a high interest rate on our savings. The issue with low interest rates is they are often kept low not only because of government debt but because the Fed is trying to encourage economic activity through consumerism. In other words, the Fed wants to discourage savings and encourage spending; including taking on more debt through credit expansion.

The Gross Domestic Product (GDP) is a nominal measurement of economic activity. GDP can grow through real production of goods and services desired by people. More importantly, GDP can grow through the expansion of the credit market and through inflation. In other words, GDP can be manipulated higher by printing money even though real production of goods and services are stagnant or falling.

Likewise, increasing credit market debt also drives up GDP. Credit is nothing more than making a future purchase today. If you buy a good for $500 you can pay for it today with cash or you can pay for it later through credit. Credit merely brings future purchases forward to today. Likewise, for people it is future earnings that pay off this past purchases. That’s not the case for government as you’ll see.

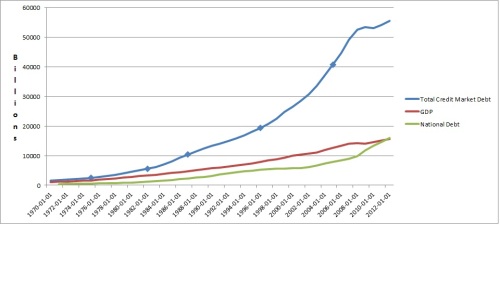

Below is a chart that overlays the total credit market debt outstanding, Gross Domestic Product, and the National Debt from 1971 through 2012. I purposely picked 1971 as the starting point because that is when President Nixon broke the 1944 Bretton Woods agreement and removed the United States from the international gold standard which is the starting point of our current monetary regime.

On the Total Credit Market Debt Outstanding (TCMDO) series I’ve ticked off every doubling of the TCMDO. From 1970 through 2007 the TCMDO has doubled 5 times which, on average, is roughly once every seven years. Compare the rate of growth in the TCMDO to the growth rate of the GDP series where it is substantially lower. So, by 2014-2015 we are due for another doubling of the TCMDO to achieve the same anemic GDP growth rates. According to the TCMDO growth from 2008 to 2012 it has essentially flat-lined as credit market debt isn’t expanding anywhere near its historical rate. This presents the Government and the Fed with a major dilemma.

On a side note, many people remember the late 1970s as a troubled economic time with high interest rates, high unemployment, and high inflation. By 1980, the price of gold reached $200 an ounce. In inflation adjusted dollars this would be $2400 today. So, in 1980 gold was at an all-time high. Private gold ownership became legal again in the 1970s and as inflation and other economic events were destroying the purchasing power of the currency people were buying gold. But, something happened in 1980 to change that (no, not Reagan’s electoral victory). Fiat currencies require confidence or else they implode. By 1980, confidence in the dollar continued to erode and people were buying gold instead. To stem the tide the Government created a new program called the 401K. In my opinion, it was created precisely to restore confidence in the dollar and to ensure people would keep their savings denominated in the currency. In return for contributing your excess savings into 401Ks (instead of gold or other non-dollar denominated assets) you didn’t have to pay taxes at that time. It was sheer brilliance by the Government to restore confidence in the dollar. But I digress.

Furthermore, from 1971 forward the trade imbalances began to widen. If you look at the net balance of payments (net of imports and exports) the U.S. imports between $400 and $700 billion more then it exports. This has widened ever since Nixon took us off the gold standard. The primary reason is that gold acts as both a brake and spur when it comes to imports and exports. Gold always flows in the opposite direction of goods.

Since, the U.S. was the de facto gold supplier under the Bretton Woods gold-exchange standard foreign banks that wanted gold had to exchange dollars for it. Under that system if the import-export balance got out of kilter (more imports) then gold flowed out of the country. In the U.S. gold peaked in the mid to late 1950s and then the supply began to shrink as the country imported more and more gold was exported. By the late 1960s, it was apparent the U.S. wasn’t able to stop the outflow of gold and eventually would not be able to redeem dollars for gold.

If a country wanted to retain its gold it would change the balance of imports and exports or even reverse it so they exported more and imported gold in return. Gold can act as a “brake” to stop the flow of gold out of the country and also act as a “spur” to start the flow of gold into the country. Generally, as you increase your exports it is a result of productive growth of goods desired by others. However, once the gold backing is removed there is nothing to stop or reverse the trade imbalance. Thus, it follows that jobs get exported as well. Because the imported manufactured goods were “cheap” it also resulted in a reduction of our domestic production capacity. Therefore, jobs were lost to overseas manufacturers. Most people fail to connect the current monetary regime (complete fiat currency without any gold backing) to the loss of productive jobs in the U.S.

It is no coincidence that government deficits ballooned starting in late 2008 through present day. Deficit expansion allows government to borrow more money in an attempt to boost the economy because the credit market debt is failing to expand at its historical rate. The Keynesian aggregate demand crowd at the Fed is attempting to stimulate the economy using low interest rates to fund government deficits and private sector credit market expansion. The next set of bubbles are being inflated whether through sub-prime auto loans, government student loans, or the financial bubble being created in the traditional and shadow banking systems. The Fed is hoping you will buy the latest gadget, finance a new car purchase, take on a student loan, or simply just use more credit to live beyond your means.

In the past five years the Government has bailed out banks through the Troubled Asset Relief Program (TARP), bailed out private companies like General Motors, passed a stimulus bill in 2009 which failed miserably and only stimulated the pockets of favored constituency groups, increased the annual federal deficit to over $1 trillion per year.

Meanwhile, the Federal Reserve has expanded its balance sheet to over $3 trillion, is purchasing $85 billion a month in mortgage backed securities, and expanded the monetary base (m0) from $800 billion in 2008 to $2.9 trillion today. The Fed is providing Federal Reserve Notes to foreign central banks – especially Europe – to provide liquidity in their failed banking system. The Fed also engages in repurchasing agreements with the primary dealers (i.e. Goldman Sachs, J.P. Morgan, etc.) where the primary dealer buys U.S. Securities from the Fed and then “repos” them back to the Fed for cash at a near zero interest rate. The Fed holds the securities as collateral and the primary dealers use the cash for their own hedge fund and proprietary trading desks.

The government and the banking system are dependent upon one another. The banking system needs the system to remain intact to continue to reap huge profits through the traditional banking system and fractional reserve banking while the government needs the Fed to set monetary policy in accordance with the Government’s best interest. Their interests are inimical to the interest of Americans. Naturally, politicians tell you otherwise, and claim to be against Wall Street and are looking out for all of us on Main Street. Nothing could be further from the truth.

The traditional banking system is where net producers (savers) deposit their excess earnings and earn a “reasonable” rate of interest on those deposits. Banks make loans using depositors’ funds to businesses and individuals. Recall, the reserve requirement of 10% of deposits. This allows the bank to lend out 90% of its deposits. Not only once, but multiple times over under our system of fractional reserve banking. One million dollars of deposits with a 10% reserve ratio can be re-lent up to $10 million. If a bank has a $1 million dollar deposit it must reserve $100,000 and can loan $900,000. The bank loans the $900,000 to someone else who then deposits that in the bank. That $900,000 requires $90,000 to be held in reserve and now $810,000 can be loaned. This process continues up to a maximum of the total deposits divided by the reserve ratio.

This is financial utopia to the bankers as they charge borrowers interest on the same money lent multiple times over creating a valid claim on money or the underlying asset for which the money was used (i.e. a mortgage is backed by the house itself). Meanwhile, the bankers aren’t risking their own money they are risking the depositors’ money.

Too often people mistake fractional reserve banking for printing money out of thin air. That is a misconception. What this does is create valid claims on money. The TCDMO of roughly $55 trillion are all valid claims on money. This is in addition to the initial deposits made by the net producer (saver). So, there is nearly $70 trillion of claims on $2.9 trillion of base money.

The process of contracting the fractional reserve system works the same way. As contraction occurs debts come due (claims on money) and must be paid. They are either paid and the system contracts or people default on their loans. So, if you don’t pay your loan the bank seizes your asset (i.e. default on your mortgage and the bank now owns your home). Bankers earn interest on loans or the underlying asset without risking a penny of their own money.

Why does this matter in relation to the question, can Cyprus happen here?

Two weeks before the Cyprus crisis European regulators gave a thumbs up to Cyprus banks. Yet, in two short weeks the banking situation went from normal to a crisis. Do you believe anyone in our Government would tell us if the banking system were to collapse? Of course they would not. Because, if they told you the system would collapse and your deposits were not secure it would cause mayhem and panic across the country. Neither the Government nor the Fed can tell you the truth.

We know there are nearly $70 trillion of outstanding debt and only $2.9 trillion of base money. All debts are valid claims on base money. Let’s consider deposits at FDIC insured banks in the United States. Today, there is roughly $8.9 trillion on deposit as FDIC insured banks. The top 50 banks and bank holding companies account for roughly $5.5 trillion of that, with Bank of America as the largest with just over $1.2 trillion in deposits.

According to regulations all FDIC banks must keep a minimum reserve of 10% of deposits. Therefore, there are $890 billion of reserves across all the FDIC banks with Bank of America having $120 billion of reserves.

Hypothetically, what if half the people wanted to withdraw their deposits from the Bank of America? Half the deposits equate to $600 billion and Bank of America has only $120 billion in reserve. Enter the Federal Deposit Insurance Corporation. Most people believe their deposits are insured up to a specific limit under the FDIC. As of 2011 the FDIC had $11 billion of deposit insurance on hand in the Combined Deposit Insurance Fund. If Bank of America depositors asked for $600 billion of their deposits the FDIC couldn’t cover that. In fact, if any major bank failed or there was a bank run, the FDIC couldn’t cover 1/100th of the demand.

The entire purpose of the FDIC was to create confidence in the banking system. The FDIC Act became law in 1934. In the preceding five years there were thousands of bank failures across the United States. In 1933, Franklin Roosevelt removed the U.S. from the domestic gold standard, made gold ownership illegal, and debased the currency by forty percent. The challenge facing the Government was how to create confidence in the banking system so people would leave their deposits in the banks. The Government gave us the FDIC.

As you read this are you pondering whether your deposits are truly insured? If not, you should be. Under the law, once the FDIC uses its reserves ($11 billion) to cover a bank failure they can request no more than $30 billion from the U.S. Treasury. Anything beyond $30 billion would require an act of Congress. The other detail most people don’t know about the FDIC Act is it is the Government’s discretion on when you would receive your deposit money back. That could be a week, a year, ten years, or fifty years. Below is the applicable section of the FDIC Act governing the repayment of deposits:

(1) IN GENERAL.–In case of the liquidation of, or other closing or winding up of the affairs of, any insured depository institution, payment of the insured deposits in such institution shall be made by the Corporation as soon as possible [emphasis added], subject to the provisions of subsection (g), either by cash or by making available to each depositor a transferred deposit in a new insured depository institution in the same community or in another insured depository institution in an amount equal to the insured deposit of such depositor

So, are you deposits truly insured? Not really. The FDIC can absorb minor bank failures, but big bank failures would be cataclysmic. This is why the Government coined the term Too Big To Fail (TBTF) and bailed out the banking system in 2008.

The moral hazard is no longer on the bank or the debt and equity holders of a large bank. The TARP bailout shifted the burden onto the backs of hardworking American taxpayers. The risk was socialized amongst the taxpayers while the rewards are privatized within the banking sector. Financial institutions recognize they have little to no moral hazard incentivizes them to take more risk. Once government removes moral hazard these financial institutions are free to operate however they please. Ultimately, this has become Too Big Too Jail as financial institutions receive minor penalties for regulatory infractions and lawlessness.

Of course, the politicians claim they are doing this for the middle class and to save Main Street. But the politicians are dependent upon these institutions for campaign donations and to keep the banking system going to ensure the politician is re-elected and retains power. This is true of both Democrats and Republicans.

If a large bank were to fail the options are 1) taxpayers bail it out. 2) the debt and equity holders bail it out. 3) the depositors bail it out. Number three was tried in Cyprus. While depositors were rightfully outraged by the idea, a complete bank failure means a total loss of deposits. In the U.S., through bank reserves and the FDIC perhaps 15% of all total deposits would be insured.

To reiterate, do you believe anyone in our government would tell us if the financial system was collapsing? If the Government explained there is no way to repay the national debt and the only choices are to repudiate the debt or inflate it away would the Government tell us? If Government was debasing the currency would they tell us?

The answer is a resounding no!

If the Government repudiated the debt it would result in immediate austerity. Once the debt is repudiated, nobody would buy our debt and Government couldn’t fund its $1.2 trillion per year deficit. All Government spending would be limited to revenues raised through taxation. Government is deficit spending to help prop up the economy and that would be withdrawn immediately. I do not believe the Government will repudiate the debt.

The other option is inflation. Many people cannot grasp the idea that the outstanding debt will not be paid off with future earnings and revenues. That’s mathematically impossible as future earnings/revenues are needed to pay for future spending – at least as much as possible. Clearly, borrowing more money doesn’t pay off past debts.

Wrap your head around this concept. The debt will be paid off by past earnings. People pay off debts with future earnings. Because Government deficit spends it can’t pay off past debts with future earnings/revenues it must use past earnings/revenues. Those past earnings that net producers have saved/invested will be used to pay off the debt. The decision comes down to whether the Government wants to tax/confiscate your deposits and/or 401Ks or whether they inflate it away. One way or the other, or a combination of the two, Government will confiscate your wealth/property. In Cyprus they talked about taxing depositors. That could happen here. More likely, 401Ks will be used in some fashion to pay the debt. There’s been talk of this for years.

In lieu of or in addition to going after 401Ks that leaves inflation as the only means to retire the outstanding national debt. In other words print more money and devalue the currency. Inflation is not an economic event, it is a political event. It is politically expedient for those in power to inflate away the debt to save the system then to make the difficult choices facing our country. In the process the currency will be destroyed and everyone with any savings (traditional or in 401Ks) will witness their money become worthless. Inflation will destroy deposits, 401Ks, money markets, and anything else denominated in the dollar.

But, a third possibility arises. One that the people themselves will demand and will most likely ensure the politicians are revered as saviors. An event such as a major bank failure, the threat of taxing deposits or 401Ks, etc. can cause enough panic that a bank run starts. People will be unable to withdraw their deposits. Hardships will ensue. Those people receiving Government payments for food stamps, housing, social security, disability, etc. will also suffer as Government payments will stop flowing. The people will scream, if not beg the government to ensure they receive their deposits and their Government checks. This is all the motivation needed to print tens of trillions of dollars of paper money. Many more “cheaper” dollars used to pay off the debt (remember debt is nominal) and the destruction of the currency in the process. Of course, the $100,000 you have in a 401K might by ten loaves of bread.

The decisions will be whether to save the system and sacrifice the currency (or vice versa) and to save the government and sacrifice the individual. Government will choose to save the system and save themselves.

In his farewell address President Andrew Jackson said, “We are not left to conjecture how the moneyed power, thus organized and with such a weapon in its hands, would be likely to use it. The distress and alarm which pervaded and agitated the whole country when the Bank of the United States waged war upon the people in order to compel them to submit to its demands can not yet be forgotten. The ruthless and unsparing temper with which whole cities and communities were oppressed, individuals impoverished and ruined, and a scene of cheerful prosperity suddenly changed into one of gloom and despondency ought to be indelibly impressed on the memory of the people of the United States.

If such was its power in a time of peace, what would it not have been in a season of war, with an enemy at your doors? No nation but the freemen of the United States could have come out victorious from such a contest; yet, if you had not conquered, the Government would have passed from the hands of the many to the hands of the few, and this organized money power from its secret conclave would have dictated the choice of your highest officers and compelled you to make peace or war, as best suited their own wishes.”

The outcome is inevitable. In fact, it’s a mathematical certainty.

In my opinion, the Government and the Federal Reserve have known for several decades that the current monetary regime that started in 1971 under Nixon was doomed to fail. It was never a question of if it would fail, just a question of when it would fail. I believe they are managing the collapse of the monetary regime to avoid the social unrest that will come along with a collapse. At some point in the future a new monetary system will begin. What triggers the beginning of that final step and how long the transition takes is unknown. What is on the other side is unknown.

Hopefully this provides some perspective around recent events and those events starting nearly forty years ago. I believe it explains many actions our Government and the Fed have taken over the years. I believe the Government and the Fed know the dollar is in the winter of its demise and a new monetary regime is forthcoming. I believe they know the current system is unsustainable, and by its very definition what is unsustainable must end. The only question is when.